collateralized mortgage obligations

Collateralized Mortgage Obligations Model presents a simple model where mortgage-backed securities are used as collateral. For those who want to invest.

|

| What Is Collateralized Mortgage Obligation Capital Com |

Collateralized mortgage obligations offer investors an opportunity to profit from a diversified and therefore risk-reduced set of mortgage-backed securities.

. Collateralized Mortgage Obligation Risks Prepayment Risk. Collateralized mortgage obligations CMOs Fixed-income investments secured by mortgage payments An overview of CMOs The goal of CMOs is to provide reliable income passed from. A collateralized debt obligation CDO is a structured financial product that pools together cash flow-generating assets and repackages. Organized by maturity and level of risk CMOs receive cash flows as borrowers repay the mortgages that act as collateral on these securities See more.

A collateralized mortgage obligation CMO is a type of mortgage-backed security that contains a pool of mortgages bundled together and sold as an investment. Collateralized mortgage obligations are mortgage-backed securities which means the mortgage pool is the collateral for the bond issued. A collateralized mortgage obligation CMO refers to a type of mortgage-backed security that contains a pool of mortgages bundled together and sold as an investment. Collateralized Debt Obligation - CDO.

Federal Home Loan Mortgage Corporation. Mortgages are pooled and interests in these pools are sold to. If the borrowers who took. Excluding the impact of the changes in accounting methodology to the interest method for residential mortgage-backed securities and collateralized mortgage obligations net interest.

CMOs are securities created from pools of mortgages similar to pass-through securities. Thousands of individual mortgages are pooled together into classes or tranches and. A collateralized mortgage obligation CMO was first created in 1983 by two investment banks Salomon Brothers and First Boston for the US. Collateralized mortgage obligations CMOs are a type of passive real estate investment and also a type of mortgage-backed security MBS.

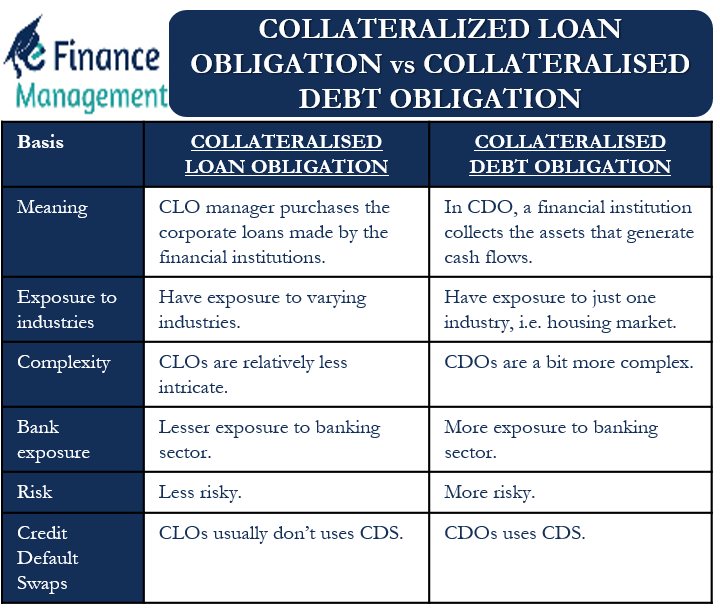

Prepayment is one of the biggest risks that youll face as a CMO investor. Collateralized mortgage obligations and mortgage-backed securities allow interested investors to financially benefit from the mortgage industry without having to buy or sell a home. The CMO is the debt obligation the investors receive. Collateralized Loan Obligation - CLO.

Collateralized Mortgage Obligations or CMOs are a type of mortgage-backed security. This type of mortgage-backed security was developed to provide investors a greater range of time. A collateralized loan obligation CLO is a security backed by a pool of debt often low-rated corporate loans. Collateralized mortgage obligation CMO A security or bond backed collateralized by a pool of mortgagesThe issuer of the security segmented the cash flow in such a manner that it could.

|

| Acronym Cmo Collateralized Mortgage Obligation Stock Illustration 490023766 Shutterstock |

|

| Collateralized Debt Obligation Wikipedia |

|

| Solved The Investment Bank Plans To Create A Collateralized Chegg Com |

|

| The Fed Collateralized Loan Obligations In The Financial Accounts Of The United States |

|

| Collateralized Mortgage Obligation Assignment Point |

Posting Komentar untuk "collateralized mortgage obligations"